Trusted By Investors From*:

UN-LIMIT YOUR INVESTMENT OPTIONS

WHAT WE DO

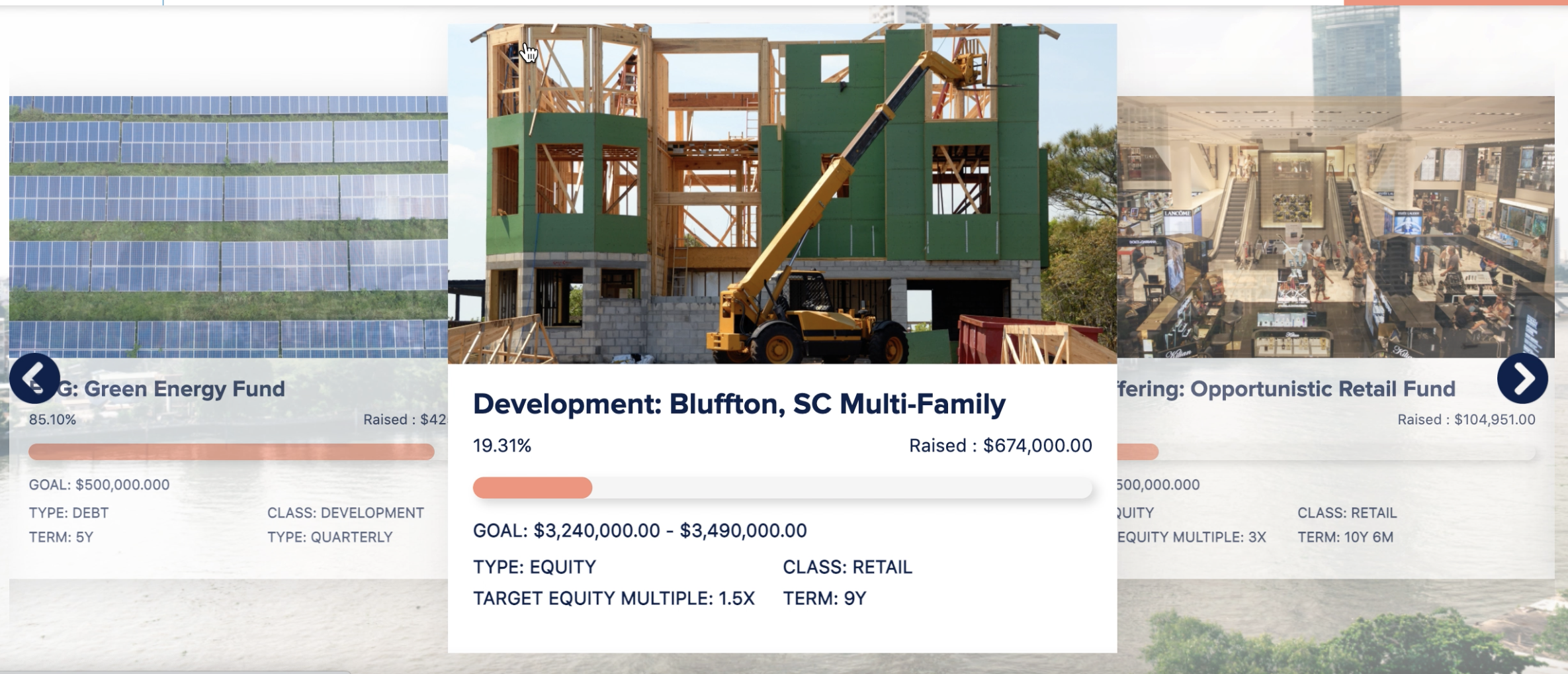

Our easy-to-use digital platform connects investors to private investment offerings selected by our industry experts. These opportunities span real estate, private equity, and private credit. Yieldwink's direct access model removes layered fee structures, ensuring greater transparency and cost-efficiency. As an independent entity, we are free from debt and the pressure of generating short-term profits for shareholders. We, the management team, commit our own capital to each investment we offer, aligning our interests directly with yours. When you win, we win. It's that simple.

Offerings*Includes deals closed by Company management

ALTERNATIVES: A SOLUTION FOR THE MODERN PORTFOLIO

Large institutions, such as endowments, sovereign wealth funds, and insurance companies, have gravitated towards alternative investments to boost diversification, minimize correlation, and enhance performance. Unlike traditional publicly traded stocks and bonds, the performance of alternative investments is less likely to correlate with public markets since they do not typically trade on a daily basis. This reduces price volatility, insulating investors from the inevitable public market swings. Since many alternative investments do not offer daily liquidity, investors are often compensated at a premium to offset the illiquidity of investing in an alternative asset.

Invest NowNEW INSIGHTS

Blog: Inside the Fed’s Mind: John Williams o...

• 4 min readMy recap of this discussion on the economy, AI, and inflation. Event Date...

Blog: Multifamily Isn't Art, It's ...

• 5 min readReal estate has no shortage of old sayings, but the one I keep taped to my...

Blog: Strategy Over Tragedy: Nestlé’s Entry ...

• 4 min readThe most lasting victories are the ones you nurture. How does a country so...

Serving Up Big Opportunities

• 3 min readServing Up Big Opportunities Yieldwink’s investment thesis focuses on...

Yieldwink

Yieldwink